If you have an expired check, you may be wondering if you can still cash it. While banks aren’t obligated to honor a check that’s older than six months, there are still steps you can take to cash an expired check. In this guide, we’ll walk you through everything you need to know to successfully cash an expired check.

What an expired check

An expired check is a check that is no longer valid because the date on it has passed. After a certain period of time, banks are not obligated to honor the check, and it may be difficult to cash it.

Importance of addressing expired checks

Expired checks can create confusion and inconvenience, and they may be difficult to cash. It’s important to take action as soon as possible to avoid any further complications.

Brief overview of steps to cash an expired check

To cash an expired check, you’ll need to determine if the check can be cashed, contact the issuer of the check, verify the check, endorse the check, and cash the check.

Determine if the Check can be Cashed

Explanation of banks’ policies on expired checks

Banks are not legally required to honor a check that is more than six months old. However, some banks may still decide to cash an expired check at their discretion. Federal Reserve often referred to as the “Fed,” is the central banking system of the United States. It was created by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system.

Checking the date on the check

The first step in cashing an expired check is to check the date on the check. If the check is more than six months old, it may be difficult to cash.

Contacting the bank to inquire about their policy

If you’re not sure if the check can be cashed, you can contact the bank to inquire about their policy on expired checks.

Contact the Issuer of the Check

Why it’s important to contact the issuer?

Contacting the issuer of the check is important because they may be able to issue you a new check or provide guidance on how to cash the expired check.

Tips on how to contact the issuer

To contact the issuer, you can call or email them, or send them a letter. Be sure to provide them with all the necessary information, such as the check number and date.

Requesting a new check

If the issuer of the check is willing to issue you a new check, be sure to provide them with your current mailing address so that they can send it to you.

Verify the Check

Explanation of what verification means

Verification means ensuring that the check is authentic and has not been altered or forged.

Tips on how to verify a check

To verify a check, you should check the name of the issuer, the amount of the check, and the date on the check. You can also compare the signature on the check to the signature of the issuer.

Common reasons a check may not be verified

Common reasons a check may not be verified include insufficient funds, a closed account, or a stop payment order.

Endorse the Check

Definition of endorsing a check

Endorsing a check means signing the back of the check to transfer ownership.

Steps to endorse a check

To endorse a check, simply sign your name on the back of the check in the designated area.

Common mistakes to avoid when endorsing a check

Common mistakes to avoid when endorsing a check include signing in the wrong place or not signing at all.

How to Cash the check at a bank

To cash an expired check at a bank, you should follow these steps:

- Endorse the check, as outlined in section V.

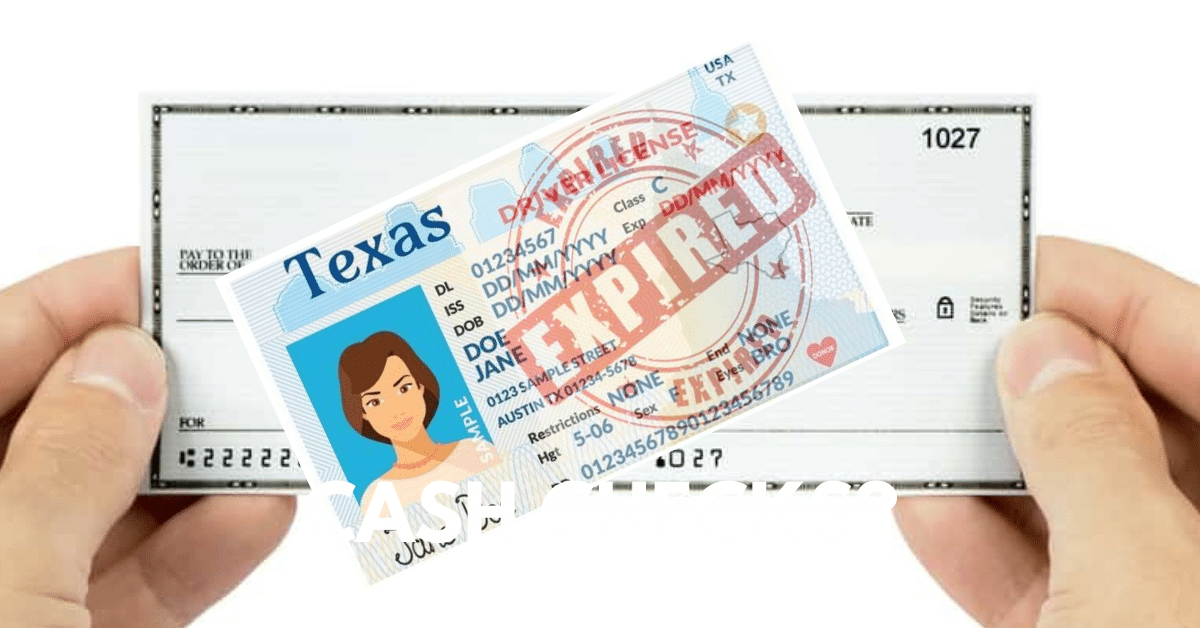

- Bring the check and a valid form of identification, such as a driver’s license or passport, to the bank.

- Request to cash the check and follow any additional instructions given by the bank.

- Be prepared to wait in line and possibly pay a fee to cash the check.

What to expect when cashing an expired check

When cashing an expired check, you may experience some delays or complications, such as additional verification steps or a hold on the funds. Be sure to ask the bank about their policy on cashing expired checks and any additional steps you may need to take.

Alternative methods of cashing an expired check

If you are unable to cash the check at a bank, there may be alternative methods available, such as using a check-cashing service or depositing the check into a prepaid card account. Be sure to research these options and weigh the pros and cons before proceeding.

Conclusion

Recap of steps to cash an expired check

To cash an expired check, follow these steps:

- Determine if the check can be cashed.

- Contact the issuer of the check.

- Verify the check.

- Endorse the check.

- Cash the check at a bank or explore alternative methods. B. Importance of addressing expired checks promptly Expired checks can become more difficult to cash as time passes, so it is important to address them promptly. C. Encouragement to take action on expired checks immediately Don’t let an expired check go uncashed. Take action today to ensure you receive the funds you are owed.

What Happens if a Check Expires or Never Gets Cashed?

Consequences of an expired or uncashed check: If a check is not cashed or deposited within a certain timeframe, it may become stale-dated, which means the bank is no longer required to honor it. The funds may be returned to the issuer or held by the bank, depending on their policy. Additionally, the issuer may be able to cancel the check or deduct the funds from the account after a certain period of time.

How to avoid these consequences

To avoid these consequences, it’s important to cash or deposits a check as soon as possible after receiving it. If you’re unable to do so, contact the issuer to request a new check or ask if they can extend the validity period.

What to do if a check expires or never gets cashed:

If a check expires or never gets cashed, you can contact the issuer to request a new check or inquire about their policy for reissuing stale-dated checks. If the issuer is no longer available, you may need to contact their estate or executor. If the check is a government-issued check, you may be able to contact the issuing agency to request a replacement. If the funds are held by the bank, you may need to provide documentation to claim them.

Frequently Asked Questions

What happens if you deposit an expired check?

If you try to deposit an expired check, it will likely be rejected by the bank, and the funds will not be credited to your account. The check may be returned to the issuer, who can then issue a new check.

Can you cash a 2-year-old check?

Legally, banks are not obligated to honour a check if it is more than six months old. However, some banks may choose to cash it at their discretion, particularly if it is a small amount. If you have a 2-year-old check, your best option is to contact the issuer and ask for a new check.

What to do if a check expires?

If you have an expired check, the first thing to do is to determine if it can still be cashed. Check with the bank’s policies regarding expired checks and the date on the check. If it cannot be cashed, contact the issuer and ask for a new check.

What happens if a check never gets cashed?

If a check is not cashed within a certain period of time, it may be considered “stale-dated” or “void after a certain period”. The period varies from state to state but is typically around six months to three years. After this period, the bank is not obligated to honour the check, and the issuer may have to issue a new one. However, the funds may still be available, so it is always best to contact the issuer and ask for a new check rather than assuming the funds are lost.

Can I still cash an expired check?

It depends on the bank’s policy. Some banks will honour an expired check, while others may not. It’s best to contact the bank or the issuer of the check to inquire about their policy.

How long do I have to cash a check before it expires?

It varies depending on the type of check and the issuing bank. Personal checks are typically valid for six months, while government-issued checks may have a longer validity period. It’s important to check the date on the check to ensure that it hasn’t expired.

Can I deposit an expired check instead of cashing it?

Again, it depends on the bank’s policy. Some banks may accept expired checks for deposit, while others may not. It’s best to contact the bank to inquire about their policy.

What if the issuer of the check is no longer available?

In this case, it may be difficult to cash the expired check. You can try contacting the bank to see if they can provide any assistance, but it’s likely that you’ll need to contact the issuer’s estate or executor to request a new check.

Can I still endorse an expired check?

Yes, you can still endorse an expired check. However, it may be more difficult to cash or deposit an expired check, so it’s best to contact the bank or the issuer of the check to inquire about their policy.

Afza Ahmad is a freelance writer specializing in finance and banking. With an in-depth knowledge of the industry, she has written extensively on topics ranging from stock market trends to international banking regulations.