You need to cash a check, but you don’t have time to go to the bank of America.

You probably feel like you’re out of options, but that’s not true. You can easily cash your check with the Bank of America App.

The Bank of America App is the fastest and easiest way to cash your check. With just a few taps on your phone, you can have your money in hand. Plus, our app is available 24/7, so you can get your cash when it works best for you. keep Reading How to Cash Check on Bank of America APP?

How to Cash Check on Bank of America APP?

When you want to Cash a check, follow these steps. First, take the check off of any other paper it is attached to. Second, put the check down on a dark-coloured surface that has enough light so you can see it well.

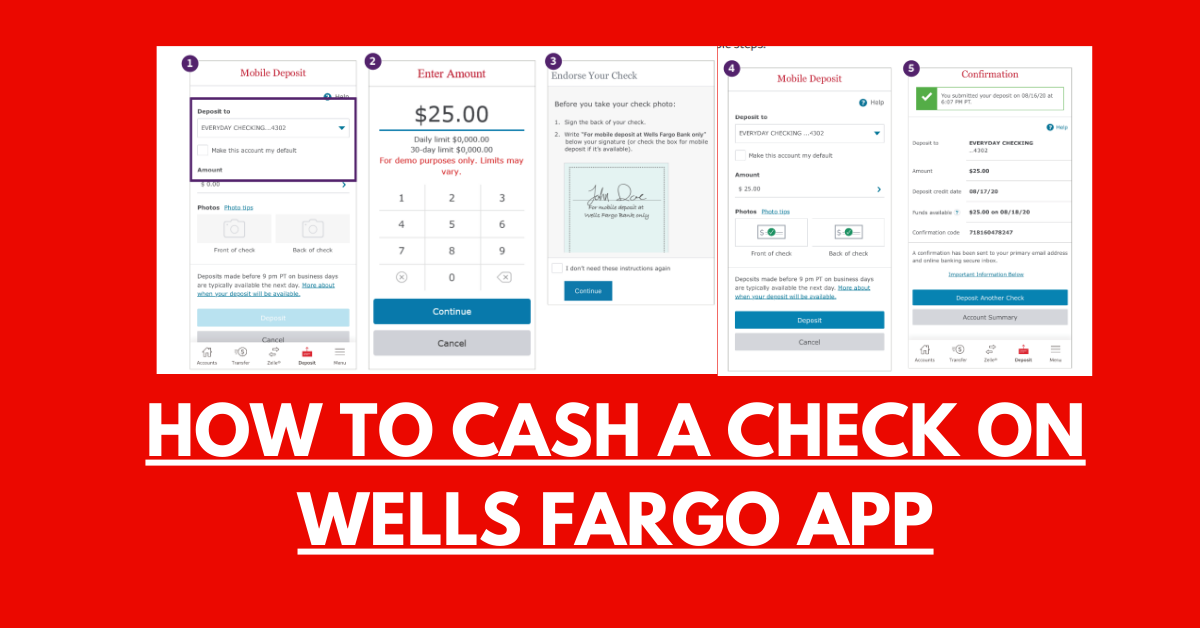

Cash Check on Bank of America APP (Step By Step Guide)

- You need to sign the back of the check and write “for deposit only at Bank of America.”

- Open the app. Log in using your fingerprint.

- Select “Deposit Checks.”

- Take pictures of the front and back of the check with your smart device by selecting the “Front of Check” and “Back of Check” buttons in the app.

- Select the account you want to deposit the check.

- Enter the amount being deposited.

- Confirm details.

- Tap “Deposit.”

Features of the Bank of America App

Bank of America’s mobile app is a comprehensive and easy-to-use banking solution that allows users to manage their accounts, make payments, and stay up-to-date on their finances anytime and anywhere. Some of the key features of the app include:

1. Account management tools that allow users to view balances, transfer funds between accounts, set up bill reminders, and more.

2. Secure and convenient payment options, such as Apple Pay, Google Pay, and Samsung Pay.

3. Real-time alerts and notifications that keep users informed about their account activity and financial commitments.

4. Easy access to a wide range of personal banking services, including savings accounts; checking accounts; loans; credit cards; and investment and retirement planning.

Overall, the Bank of America app is a powerful and convenient tool for managing your finances on the go, making it an essential tool for users of all experience levels.

Whether you’re a business owner or simply looking to better manage your finances, this app has everything you need to stay on top of your money. So why wait? Download the Bank of America app today and start taking control of your financial future!

How Long Does Bank of America Mobile Deposit Take?

The time it takes for a Bank of America mobile deposit to show in your account depends on when you deposited the money, the type of deposit, and the time zone where your account was opened.

Check Cash

For example, suppose you opened your account in the Eastern time zone and deposited a check before 9 pm ET on a Thursday. In that case, your funds will be available the next day, on Friday.

If you make a deposit on Friday after 9 pm, your funds will be available on Tuesday. Deposits made on Saturday or Sunday will also be available on Tuesday.

Deposits made on a federal holiday will hit your account the next day that banks are open. If the holiday falls on a Monday, for example, your money will be available on Wednesday.

When Funds May Be Delayed

There are times when the bank might not be able to give you your money right away. But don’t worry. You will get an email or message from the bank telling you what is happening. The first $225 of your deposited funds will be available the next business day.

Some different rules apply to new accounts. For the first 30 days after you open your account, the money from personal check deposits will usually be available five business days after you deposit it.

When you deposit a certified or cashier’s check, the first $5,525 is available on the second business day. The rest of the money is available on the fifth business day.

Transfers

If someone sends money to your account from their Bank of America account, you can use that money right away.

However, if you make a transfer after 11:59 pm ET on a weekday, you will not see it in your transfer history until the next day. If you make a transfer on a Saturday, Sunday, or holiday, you will see it in your transfer history on the next business day.

What are the Mobile Deposit Limits of Bank of America

The Bank of America imposes limits on how much money you can deposit into your account using the mobile deposit feature. The limits depend on how old your account is and whether or not you are a member of the Bank of America Preferred Rewards program. You can see your limit by selecting your deposit account on the mobile app.

What are the Mobile Deposit Fees of Bank of America

There is no charge from Bank of America to deposit money using your mobile phone. But your phone company might charge you for sending messages or using data.

FAQ’S Bank of America App

Does Bank of America cash checks instantly?

Deposits to a Bank of America account will not be available immediately. If there is no hold on the deposit, it will be processed that night and available the next business day.

Can I cash out Bank of America checks without an account?

There are a few ways that you can cash a check without a bank account. You can cash it at the issuing bank or a check-cashing store. If you have lost your ID, you can use an ATM or sign it for someone else.

How to endorse a check for a mobile deposit bank in America?

Sign the back of the check and write “for deposit only at Bank of America.” Take pictures of both the front and back of the check using your smartphone. Select the account to receive the deposit, enter the amount, and tap Next. After confirming the details, tap Submit.

Can I deposit someone else’s check into my Bank of America account?

Yes, if the person writes their name on the back of the check (endorse their check) and you know what bank account to put it in. (The person should write the account number on the back of the check.

Why does Bank of America hold checks for so long?

The hold allows Bank of America time to check whether the check is good. This can help you avoid fees if the check is not good and they must take the money back. Even if they give you the money from the check, it might still not be good, and they will take the money back anyway.

Can you cash a Bank of America check at another bank?

No, a bank or credit union does not have to cash the check. If you go to a bank or credit union and neither you nor the person who wrote the check has an account, often such institutions will not cash the check.

Afza Ahmad is a freelance writer specializing in finance and banking. With an in-depth knowledge of the industry, she has written extensively on topics ranging from stock market trends to international banking regulations.