How To Cash A Check On Well Fargo App

Have you ever tried to cash a check but needed the right app? The Wells Fargo app is the perfect tool for cashing checks. You can use it to deposit checks, transfer funds, and even pay bills. And now, with our new “How to Cash a Check on Well Fargo APP” guide, you can learn how to use the app to cash a check in no time.

With the Wells Fargo app, there’s no need to go to the bank or stand in line. You can cash your check from anywhere, anytime. And our new guide will show you how easy it is to do. Just download the app and follow our simple instructions.

Features of the Wells Fargo Mobile App

- Wells Fargo Mobile Banking App offers fast and easy access to your account

- Making it easy to check balances, view transactions, and more.

- The Wells Fargo Mobile Banking App allows you to deposit checks quickly and easily.

- You can also use the Wells Fargo Mobile Banking App to pay bills, transfer money, and more.

- The app is available for both Android and iPhone users.

- The app offers a variety of features that make banking more effortless than ever before.

Do I need an ID to cash a check on Wells Fargo Mobile App?

You don’t need an ID to cash a check at Wells Fargo, but you will need to provide some form of identification if the check is for more than $500. Acceptable forms of identification include a driver’s license, state ID card, passport, or military ID. Suppose you don’t have any of these forms of identification. You can provide another form, such as a birth certificate or Social Security card.

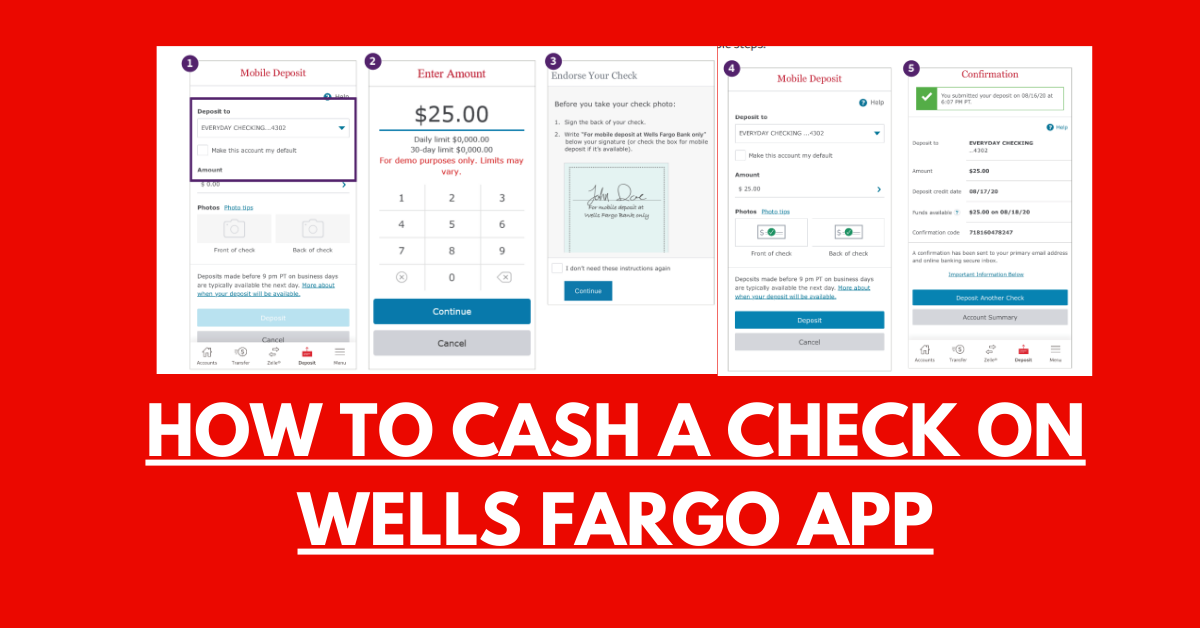

How to Cash a Check on Well Fargo APP

People often need help figuring out what to do when they want to cash a check.

You may ask yourself, “Can I cash a check at Wells Fargo?” or “How do I cash a check at Wells Fargo?”

The Wells Fargo App makes it easy for you to cash checks without having to leave your home. You can follow the app’s instructions to get your money quickly and easily.

Login Into Your Wells Fargo Account – Step 1

To login into your Wells Fargo account, you must provide your username and password.

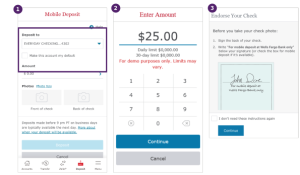

Choose the deposit, In the bottom right bar – Step 2

Once logged in, you will need to find the “deposit” option. This can be found in the right-bottom corner of your screen. Click on it.

Select the type of account you are Depositing to – Step 3

You will then need to select the account you are depositing to. This can be either your Default Account or savings account.

Enter the Amount of the Check – Step 4

You will then need to enter the amount of the check. Ensure you include the dollar sign ($) and cents (00).

Click On continues – Step 5

After you have entered the check amount, click on “continue.” This will take you to the next step in the deposit process.

Endorse your check – Step 6

Endorsing a check means signing it on the back so it can be deposited into someone else’s account. To endorse a check, you must print your name on the back, just above the signature line. Make sure you write neatly so the bank can read your signature.

“So Don’t Forget to sign the back of your check and the Front of the check.”

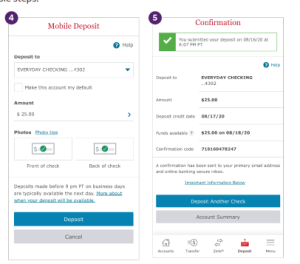

Snap the Front and then Back sides of your check – Step 7

After you have endorsed the check, you must take a picture. Ensure you get the Front and back sides of the check in the photo.

Click On Deposit Button – Step 8

After you have taken a picture of the check, you will need to click on the “deposit” button. This will take you to the next step in the deposit process.

Now Wait for Confirmation

Step After you have clicked on the “deposit” button, you must wait for confirmation. This will let you know that the bank has received your check and is processing it. You will be able to see the progress of your deposit in the “activity” tab of your Wells Fargo account. Once the check has been deposited, the “activity” tab will show a message that says “check deposited.”

What to do After Submitting a Check?

After sending in a check, please keep it for a few days. The bank might need to look at the paper check to ensure there is no transaction problem. For example, the pictures might need to be more precise, or too much money might be deposited. You may have typed in the wrong number.

What to Do After Check Clearance From Bank?

Once the check clears and the funds are available, you can dispose of it. You want your check to end up in the right hands and be cashed or deposited with your knowledge.

How Much Time Does it Take to Check Clearance?

It will take some time for the funds to be deposited into your account after you have cashed a check with the Wells Fargo app.

The money will be available as soon as the check has been cleared, which can take a few days. If you need access to the funds immediately, you can use the mobile banking app to withdraw them from an ATM.

Frequently Asked Question

Afza Ahmad is a freelance writer specializing in finance and banking. With an in-depth knowledge of the industry, she has written extensively on topics ranging from stock market trends to international banking regulations.